rhode island tax table 2019

That sum 122344 multiplied by the marginal rate of 72 is 8809. Ad Register and Subscribe Now to work on your RI DoT Form RI-1040NR more fillable forms.

Cpi April 2021 Inflation Speeds Up In April As Consumer Prices Leap 4 2

Finally we add 8809 to the base taxes 70800 to get a total Rhode Island estate tax burden of 79609 on a 32 million estate.

. The state sales tax rate in Rhode Island is 7 but you can customize this table as needed to reflect your applicable local sales tax rate. Assuming you filed a nonresident Rhode Island Form RI-1040 last year you will find the total tax on page 1 line 8 RI income tax from Rhode Island Tax Table or Tax Computation Worksheet. Tax Rate Income Range Taxes Due 375 0 to 66200 375 of Income 475 66200 to 150550 248250 475 599 150550 648913 599 over 150550.

The tax rates in Coventry and North Smithfield have been rounded to two decimal places. 7 Rhode Island has state sales tax of 7 and allows local governments to collect a local option sales tax of up to NA. Rhode Island also has a 700 percent corporate income tax rate.

2022 Rhode Island state sales tax. 7 Average Sales Tax With Local. Rhode Island state income tax Form RI-1040 must be postmarked by April 18 2022 in order to avoid penalties and late fees.

New employees must submit Form RI W-4. Rhode Island has a 700 percent state sales tax rate and does not levy local sales taxes. Any income over 150550 would be taxes at the highest rate of 599.

Find your pretax deductions including 401K flexible account contributions. Divide the annual Rhode Island tax withholding by 26 to obtain the. Like most other states in the Northeast Rhode Island has both a statewide income tax and sales tax.

The state has a progressive income tax broken down into three tax brackets meaning the more money your employees make the higher the income tax. As you can see your income in Rhode Island is taxed at different rates within the given tax brackets. Rhode Island State Payroll Taxes.

3243 - commercial I and II industrial commind. The Rhode Island Division of Taxation has released the state income tax withholding tables for tax year 2020. Rhode Island annual income tax withholding tables percentage method for wages paid on or after January 1 2019.

We last updated Rhode Island Tax Tables in January 2022 from the Rhode Island Division of Taxation. Click here for a larger sales tax map or here for a sales tax table. The Rhode Island State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 Rhode Island State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state.

Tax rate of 599 on taxable income over 155050. Tax rate of 375 on the first 68200 of taxable income. Rhode Island has a graduated individual income tax with rates ranging from 375 percent to 599 percent.

For married taxpayers living and working in the state of Rhode Island. The rates range from 375 to 599. The steps in computing the income tax to be withheld are as follows.

State of Rhode Island Monthly State Hotel Tax Report FY 2019 State 50 Percent Hotel Tax Allocation June 2019. Check the 2019 Rhode Island state tax rate and the rules to calculate state income tax. Find your income exemptions.

See If You Qualify To File State And Federal For Free With TurboTax Free Edition. West Warwick taxes real property at four distinct rates. Detailed Rhode Island state income tax.

The income tax is progressive tax with rates ranging from 375 up to 599. The Rhode Island Department of Revenue is responsible. Ad Compare Your 2022 Tax Bracket vs.

There are a total of 28 local tax jurisdictions across the state collecting an average local tax of NA. The Rhode Island state sales tax rate is 7 and the average RI sales tax after local surtaxes is 7. Employees must require employees submit state Form RI W-4 if hired in 2020 or when making withholding tax changes in 2020.

The Rhode Island income tax rate for tax year 2021 is progressive from a low of 375. Discover Helpful Information And Resources On Taxes From AARP. 2019 Forms W-2 filing reminders.

Find your gross income. Apply the taxable income computed in step 5 to the following table to determine the annual Rhode Island tax withholding. Tax Rate Starting Price Price Increment Rhode Island Sales Tax Table at 7 - Prices from 100 to 4780 Print This Table Next Table starting at 4780 Price Tax 100 007 120 008 140 010 160 011.

Printable Rhode Island state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021. The 2019 Form RI W-4 which the employer is required to keep on file is included in the 2019 employer withholding booklet and available separately here. See Why Were Americas 1 Tax Preparer.

The bottom of the threshold is 154 million so we subtract that from 1662344 million and get 122344. Exact tax amount may vary for different items. Tax rate of 375 on the first 68200 of taxable income.

Your 2021 Tax Bracket To See Whats Been Adjusted. Rhode Island 2020 income tax withholding tables available. This means that these brackets applied to all income earned in 2018 and the tax return that uses these tax rates was due in April 2019.

In June 2012 the Rhode Island Department of Revenue began issuing a report on the allocation of the state 50 percent hotel tax as required by Rhode Island General Laws 42-631-3 and42-631-12. Vacant land combination commercial structures on rented land commercial condo utilities and rails other. 2989 - two to five family residences.

Federal exemption for deaths on or after January 1 2023. However if Annual wages are more than 231500 Exemption is 0. Ad File Your State And Federal Taxes With TurboTax.

If you prepared your tax return using TurboTax last year you can log into your account to access your 2019 income tax returns and obtain the amount from the. Groceries clothing and prescription drugs are exempt from the Rhode Island sales tax. More about the Rhode Island Tax Tables.

This form is for income earned in tax year 2021 with tax returns due in April 2022. Beginning in 2019 the cap on the Connecticut state estate and gift tax is reduced from 20 million to 15 million which represents the tax due on a Connecticut estate of approximately 129 million. Rhode Islands tax system ranks 40th overall on our 2022 State Business Tax Climate Index.

We will update this page with a new version of the form for 2023 as soon as it is made available by the Rhode Island. Tax rate of 475 on taxable income between 68201 and 155050. Multiply the adjusted gross biweekly wages times 26 to obtain the gross annual wages.

Counties and cities are not allowed to collect local sales taxes. The Rhode Island income tax has three tax brackets with a maximum marginal income tax of 599 as of 2022. The highest marginal rate applies to taxpayers earning more than 150550 for tax year 2021.

Rhode Islands income tax brackets were last changed one year prior to. How to Calculate 2019 Rhode Island State Income Tax by Using State Income Tax Table. Now that were done with federal income taxes lets tackle Rhode Island state taxes.

Julian Feiner Director Of Tax Qualified Australia Clifford Chance Linkedin

Radiologist Resume Samples Velvet Jobs

Tropical Forests Lost Decade The 2010s

Updates To The Insurance Uber Maintains On Behalf Of Drivers And Delivery People Uber Blog

Interactive Redlining Map Zooms In On America S History Of Discrimination The Two Way Npr

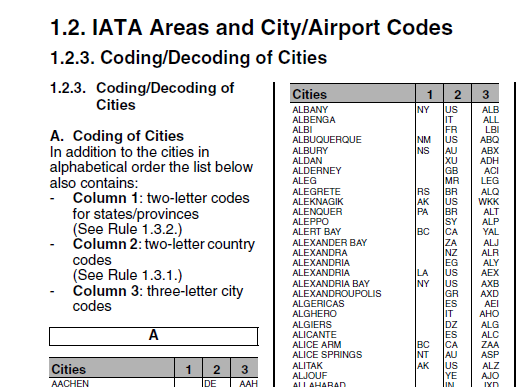

Iata Air Cargo Tariffs And Rules What You Need To Know

Canada S Wonderland Travel Guide At Wikivoyage

Us New York Implements New Tax Rates Kpmg Global

Julian Feiner Director Of Tax Qualified Australia Clifford Chance Linkedin

Julian Feiner Director Of Tax Qualified Australia Clifford Chance Linkedin

Time For The Great Saf Rush Florence School Of Regulation

Julian Feiner Director Of Tax Qualified Australia Clifford Chance Linkedin

Updates To The Insurance Uber Maintains On Behalf Of Drivers And Delivery People Uber Blog

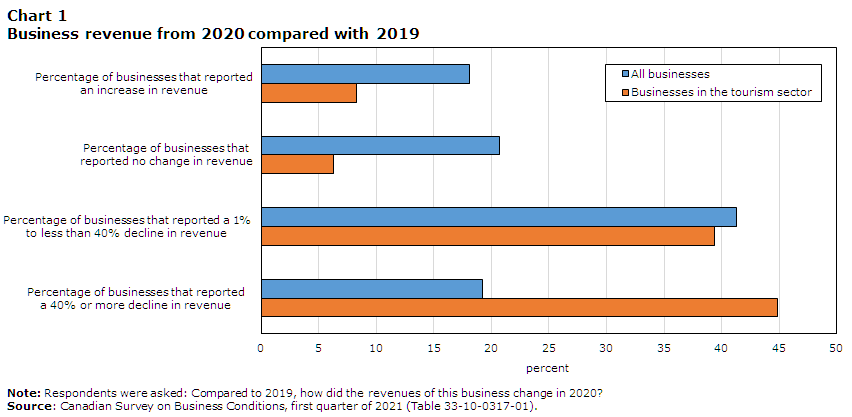

Impact Of Covid 19 On The Tourism Sector Second Quarter Of 2021

.png)